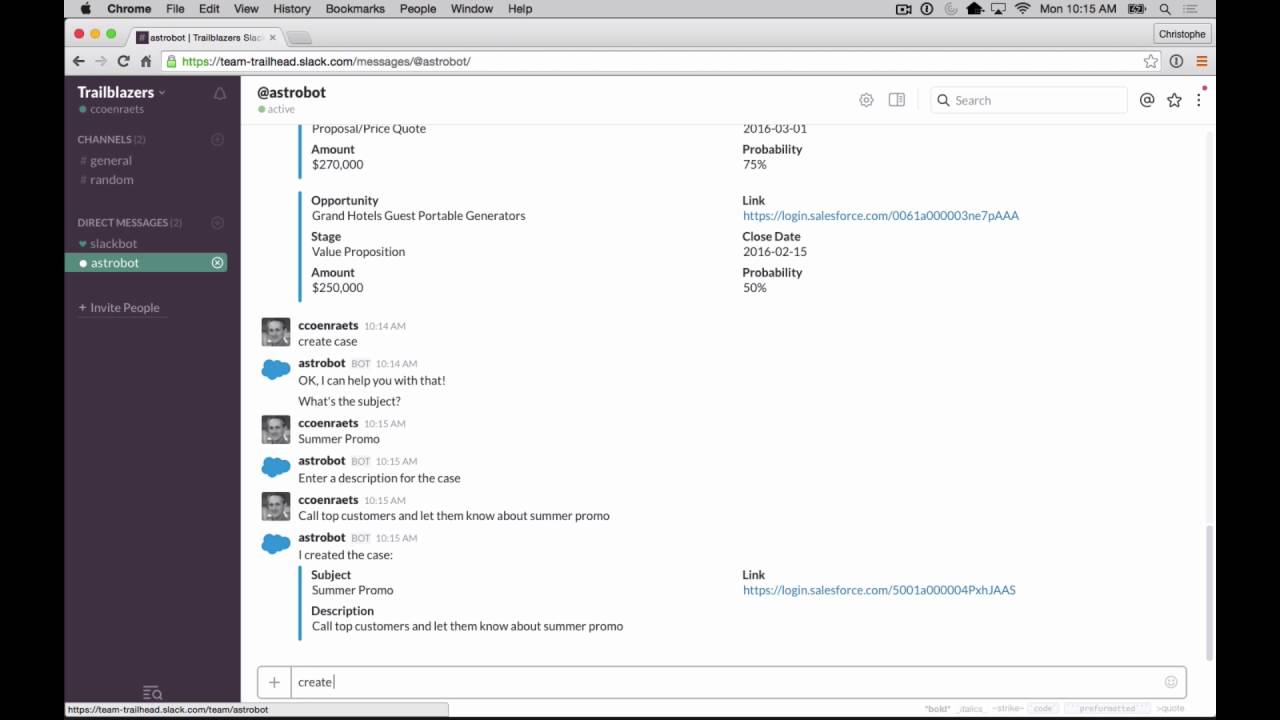

Slack is a team collaboration application that has gained a significant amount of momentum over the last few years. One of the things that sets Slack apart is the simple and powerful way it can integrate with external applications. In this article, we will review three approaches you can use to integrate Slack and Salesforce. The Salesforce and Slack integration allows you to search your Salesforce instance from Slack, and share results in Slack. The integration also allows you to share messages both ways between Salesforce Chatter and your Slack channel (s). Since Salesforce and Slack coming together, Slack has been able to sell through Salesforce executives and their channel accounts, besides their own sales ave. Co-founder and CEO Marc Benioff said in a statement that the deal was a 'match made in heaven,' and stressed Slack's importance to the future of remote work. 'Together, Salesforce and Slack will.

The rumor mill churns with whispers Salesforce will acquire Slack. This combination would be strategic for both involved for three reasons.

First, Salesforce and Slack share Microsoft as their most significant competitor. Microsoft Teams' rapid assault and consequent market power into the corporate instant messaging market transformed the market dynamics in less than 12 months.

Microsoft has amassed the most extensive channel for SaaS companies, and each of these vendors pushes teams to current customers, many of whom are moving to the cloud and relying on Microsoft for guidance.

Combining with Salesforce would enable Slack to sell through Salesforce account executives and the Salesforce channel in addition to their go-to-market efforts. The merger would establish a greater degree of parity in GTM muscle.

Second, Slack + Salesforce enables superior integration of instant messaging workflows into this generation’s essential system of record.

With Teams bundled into Microsoft cloud upgrades and often given away for free as part of a package deal, many CFOs wonder why companies ought to pay a premium for additional instant messaging software. This slash-and-burn market tactic has propelled Team’s rise in market share.

But as instant messaging has evolved, many users and buyers have realized the most valuable mode d’emploi streamlines internal workflows. Better workflows rebut the premium instant messaging objection.

Is Salesforce Buying Slack

The Slack ecosystem has blossomed with some startups leveraging the platform’s distribution. But imagine if Slack integrated natively into the entirety of the Salesforce ecosystem. Sales acceleration, marketing, finance tools all built on Salesforce data with Slack delivering the user interface. That’s justification for an upgrade.

For Salesforce, the value proposition resonates, too. Today, AEs use Salesforce a few times per day at most - and then begrudgingly. Slack is a perpetual background process used many times per hour. User engagement could catalyze Salesforce upgrades. Salesforce benefitted from Chatter’s launch a decade ago. But there isn’t as much chatter on Chatter as Salesforce might have hoped. Slack remedies that deficiency instantly.

Third, the next horizon for instant messaging is the development of custom workflows within large enterprises. These workflows require platforms-as-a-service (PaaS) products that simplify development. Engineers need databases and execution environments for this code. Microsoft has been pushing in this direction for the last nine months with Dataflex.

Salesforce owns Heroku, a platform-as-a-service, that would serve as a developer-friendly substrate for engineers to develop key workflows that combine the Slack UI with Salesforce’s massive data repository and a broad ecosystem of inter-related marketing, finance, and sales data.

Coincidentally, this thesis of combining messaging with custom workflows led to our investment in Mattermost, an open-source messaging platform focused on developer workflows like incident response, chat ops, and social coding. I believe in this convergence.

For non-technical teams, a Salesforce and Slack merger would provide the ecosystem with a worthy competitor to Microsoft Teams and the broader Microsoft ecosystem. Plus, the combination would complement and reinforce the value propositions of both. If the merger does happen, it would reshape the SaaS landscape.

Salesforce, a cloud-services company that targets businesses, has announced that it will acquire workplace communication service Slack for $27.7 billion. The announcement follows a week of rumors and a steep bump in Slack's value on the stock market in anticipation of the deal being made official.

Neither company has yet to announce in any detail what this will mean for users and customers. Salesforce is sure to include Slack in some of its broader bundles, and to more tightly integrate Slack with its other software services. 'Slack will be deeply integrated into every Salesforce Cloud' and will become 'the new interface for Salesforce Customer 360,' the press release says.

But anything else beyond that is speculation at this point. New features and development priorities or adjusted pricing models are possibilities, but we also don't yet know when any user-relevant changes related to this acquisition will actually take place, either.

While Salesforce and Slack signed a definitive merger agreement, the deal is not final. 'The transaction is anticipated to close in the second quarter of Salesforce's fiscal year 2022, subject to approval by the Slack stockholders, the receipt of required regulatory approvals, and other customary closing conditions,' Salesforce's announcement said. The second quarter of Salesforce's fiscal year 2022 will end on July 31, 2021. The deal could be reviewed by the incoming Biden administration.

The mutual benefits for Slack and Salesforce as businesses are clear, even if it's wait-and-see in terms of any benefits or downsides for users and customers. Salesforce is in a fierce competition with Microsoft to win over businesses that are in the market for cloud-based services and products. Microsoft runs arguably the most significant Slack competitor, Microsoft Teams, but Salesforce had not matched either Slack or Teams with an equivalent offering.

Advertisement

Advertisement The Slack acquisition bolsters Salesforce's portfolio of services as it tries to sign businesses on to deals that would make Salesforce more or less a one-stop shop for those businesses.

Slack, on the other hand, has struggled somewhat since its initial public offering (IPO) last year, despite the COVID-19 pandemic accelerating a remote-work revolution that one would expect to benefit a remote communications tool for businesses. The company has struggled on its profitability path, and its valuation has fluctuated since the IPO but has rarely grown significantly beyond its initial price.Slack's valuation on the market leaped dramatically since the rumors of the acquisition broke; in early November, the company's shares were valued as low as $24.10. After market close today, shares were up to $43.84.

As is usually the case with announcements like this, executives from both companies released statements. Here's the word from Salesforce CEO Marc Benioff:

Salesforce And Slack Merger

[Slack CEO Stewart Butterfield] and his team have built one of the most beloved platforms in enterprise software history, with an incredible ecosystem around it... This is a match made in heaven. Together, Salesforce and Slack will shape the future of enterprise software and transform the way everyone works in the all-digital, work-from-anywhere world. I’m thrilled to welcome Slack to the Salesforce Ohana once the transaction closes.

And from Slack's Butterfield (who previously founded photo-sharing website Flickr and the failed gaming platform Glitch):

Salesforce started the cloud revolution, and two decades later, we are still tapping into all the possibilities it offers to transform the way we work. The opportunity we see together is massive... As software plays a more and more critical role in the performance of every organization, we share a vision of reduced complexity, increased power and flexibility, and ultimately a greater degree of alignment and organizational agility. Personally, I believe this is the most strategic combination in the history of software, and I can’t wait to get going.

Who Owns Slack

Salesforce And Slack

'Under the terms of the agreement, Slack shareholders will receive $26.79 in cash and 0.0776 shares of Salesforce common stock for each Slack share, representing an enterprise value of approximately $27.7 billion based on the closing price of Salesforce’s common stock on November 30, 2020,' the press release says.